Inflation and home construction costs were both pushed higher by the once-booming lumber market in 2021 and 2022, but prices have since fallen. In May 2021, spot lumber prices reached a record high of $1,514 per thousand board feet. This week, they dropped to $366, returning to levels seen before the pandemic, according to the Random Lengths’ Framing Lumber Composite Price Index. A steep fall has also occurred in the futures market, with July contract prices plummeting 28% to $466/000 board feet, or about $100 more than spot prices (due to delivery fees).

The Demand Side of Lumber Market: Housing Affordability and Renovation Slowdown

Lumber demand has taken a hit due to the steep decline in the affordability of housing in the US and the subsequent slowdown in home renovations. The Atlanta Federal Reserve’s Home Ownership Affordability Monitor (HOAM) Index has reached its lowest point since the financial crisis of 2008, as a result of historically high mortgage rates and skyrocketing home prices.

Senior economist Dustin Jalbert of Fastmarkets’ Wood Products team made the comment, “It’s one of the least affordable times to buy a house in decades.” The demand for lumber has been weak due to the lowered demand for new homes caused by the affordability crisis. There was a 52% year-over-year decline in multi-family housing starts and a 19% year-over-year decline in home builder confidence, both of which are at five-month lows.

Home renovations, which experienced a boom due to the pandemic, have also begun to decline. Take Home Depot as an example. They announced a 3.2% drop in U.S. comparable sales for the first quarter. One interesting thing is that they saw a significant drop in larger discretionary projects like kitchen and bath remodels.

The fact that traders are getting “premium” lumber, which is usually only sold to big retailers like Home Depot and Lowes, suggests that retail buyers are pushing back, according to Ashley Boeckholt, director of lumber and risk management at Sitka Forest Products USA. The demand for wood products has been significantly reduced due to the slowdown in home renovations and the persistent affordability issues with housing.

The Supply Side: Overproduction and the Bullwhip Effect

The situation is just as difficult from a supply perspective. Many in the industry were expecting continued high demand owing to the housing shortage and possible interest rate cuts, which caused the surge in lumber prices in 2021 and 2022 to prompt increased production investments. The problem is that new sawmills and increased supply take a long time to set up, so there is a glut of lumber on the market at the moment when demand is at an all-time low.

According to Jalbert, this is an example of the “classic bullwhip” effect, in which supply rises in reaction to demand but falls short of expectations. Boeckholt agreed, saying that the industry’s unrealistic expectations during the pandemic’s lucrative years are to blame for the present market slump.

Future Outlook for Lumber Prices

Based on his forecasts, Boeckholt thinks lumber prices will stay around where they are now until the end of the year, with the possibility of a small increase of around $50 in the fourth quarter. Jalbert anticipates that prices will remain flat through 2024, and that sawmills may cut back on production in 2025 in response to low prices, leading to a decrease in supply and a potential recovery the following year.

Jalbert projects that by 2025, lumber futures prices could reach $500 to $600/board foot, thanks to a combination of factors including the possibility of interest rate cuts, which could increase demand. “Supply is going to be cut and demand will recover,” said the CEO. “But that’s going to take time.”

As the lumber market faces these difficult times, those involved will be keeping a careful eye on the dynamics of supply and demand in the years to come.

- Online Student Seva Portal (OSSP.IN) : Education & Career Updates

- Sarkari Tab: Complete information about government tabs in easy language

- How to detect fake Sapphire Gemestones | 4 Ways to Determine if a Sapphire is Real

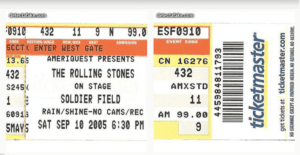

- How to Spot fake Ticketmaster Event Tickets? How do you check if my Ticketmaster tickets are real?

- How to detect fake Pandora Beads and Charms | Identifying Authentic Pandora Products

- How to detect fake Playstation 4 / PS4 Controllers | 9 Ways to Spot with Images

- How to Detect Fake AirPods Pro 2 with Screenshots

- How to detect fake Apple iPod Touch? Know the authentication of your ipod

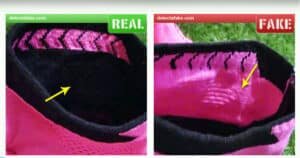

- How to Spot fake Nike Air Jordan XIV (14) Retro in 2023 (All Colorways)

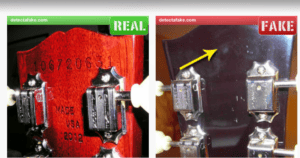

- How to Spot fake Gibson Guitars Is Your Music Instrument is Authentic?

- How to Detect Real vs Fake Diamond Chain with Screenshots

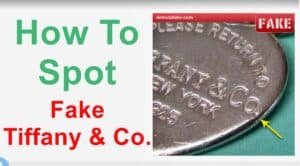

- How to detect fake Tiffany & Co. Jewelry | Tiffany & Co. Jewelry: How to Spot the Real Deal

- How to detect fake Super Nintendo Classic Edition | 6 Ways to Spot with Images

- HoHow to detect fake: Nike Air Jordan XXI (21) Retro in 2023 (All Colorways)

- How to detect fake Silver Bullion Bar | How To Tell The Difference Between Real And Fake Silver

- How to detect fake Nike Air Max 2014 | Step by Step with Images

- How to detect fake: Nike Air Max 2015 | Step by Step with Images

- How to detect fake: Nike Foamposites | 10 Steps (easy)

- How to detect fake: Nike Mercurial Superfly 6 Very Easy Ways!

- How to get IRS 4th Stimulus check: Check Your Elegibility and Documents Apply Now