Simplified Loan Solutions

What is Simplified Loan Solutions?

” Simplified Loan Solutions” describes a service or company that aims to enhance the loan application and management procedure. Through simpler application treatments, quicker approval times, and transparent terms, the service aims to make acquiring and handling a loan less complex for customers and businesses.

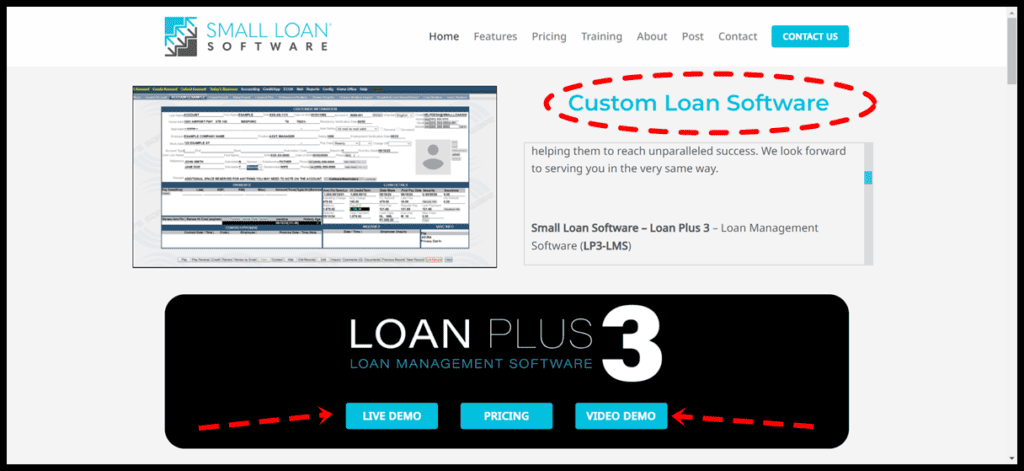

Intro to Loan Software

You know the old saying, “Time is money”? On the planet of lending, this couldn’t be more accurate. Let’s dive deep into the ocean of loans, and surface with an understanding of how software solutions are simplifying them.

The Need for Simplification in Loans

Ever been bogged down by documents when taking out a loan? Or spend hours on a phone call, waiting for approval? Those days are long gone. In our fast-paced world, customers demand speed, performance, and clarity. They desire loan procedures that aren’t bound by bureaucracy but are, instead, fast and simple.

How software application options have transformed the loan industry

Get into small loan software options. They’re the game-changers, the unsung heroes behind the scenes, making loan processes as smooth as silk. Picture a tool that enhances applications, processes them in seconds, and makes sure that every data point is secure. That’s what we’re discussing here.

Features of Efficient Loan Software Application

User-Friendly User interface

A superior loan software application will have an interface that’s as user-friendly as talking with a friend. Debtors ought to have the ability to navigate easily, input information without confusion, and receive real-time feedback.

Automated Processing

Why wait until automation can finish the job? Automated processing ensures quick loan decisions, reducing manual work and decreasing mistakes.

Secure Data Management

Trust is vital. Debtors delegate their details to lending institutions, and it’s the software application’s job to protect them like a treasure. Top loan software options offer encrypted data storage, guaranteeing utmost security.

Customizable Loan Criteria

Every customer is distinct, therefore are their needs. The very best loan software application offers personalization choices to tailor loan parameters to private requirements.

Advantages for Lenders and Customers

Quick Choice Making

Remember the days of waiting? They’re over. With software services, choices are made at the speed of light. It’s a win-win for both loan providers and debtors.

Enhanced Customer Experience

Pleased customers cause more organization. A smooth loan procedure improves clients’ complete satisfaction, guaranteeing they come back for more.

Efficient Danger Management

Lenders, how typically have you been burned by a bad loan? With innovative analytics and real-time information processing, software options decrease these threats.

Picking the Right Loan Software

Elements to think about

When it comes to selecting software applications, consider it like choosing a pair of shoes. It needs to fit the ideal and serve its function. Consider its functions, security procedures, and customer reviews.

Top service providers in the market

While there are numerous fish in the sea, not all are golden. Research, compare, and then leap.

Future of Small Loan Software Solutions

Combination of AI and Machine Learning

The future is bright, and it’s driven by AI. Envision software that gains from every loan processed, continuously enhancing and enhancing.

Enhanced Predictive Analysis

It’s like having a crystal ball. Future software applications will be able to anticipate loan defaults with even higher accuracy, safeguarding lending institutions and ensuring a healthy lending environment.

Loans do not need to be complicated. With the ideal software, they can be as basic as making a cup of coffee. Whether you’re a lending institution seeking to enhance your processes or a borrower looking for a simpler method to get funds, small loan software application options are the answer. Ready to dive in?

FAQs

- What is a small loan software application?

” Small loan software application” is a thorough loan management software platform tailored to various lending institutions, consisting of banks. It helps with the management and administration of a series of loan types such as regulated installation loaning, consumer finance loans, title loans, and product and services financing loans. - How does automation aid in loan processing?

Automation speeds up the decision-making procedure, minimizes mistakes, and uses a more streamlined experience for both lenders and customers. - Is my data protected with these software application options?

Yes, top software services focus on information security, typically using encryption to safeguard user details. - Can I tailor the loan terms with these software application tools?

Definitely! Lots of software application services offer personalized loan specifications to deal with individual customer requirements.